Fitness apps have been growing in popularity ever since the pandemic hit in 2020, and there’s no sign that they’re losing their appeal.

Indeed, with the warmer and lighter days of summer upon us, many people are keen to get outdoors and exercise more, which means they’re turning to their smartphones and searching for apps that can aid them in reaching their fitness goals.

With so many apps catering for this growing demand, exercise-hungry smartphone users certainly have a lot more choice now than they did just a few years ago.

The global fitness app market size stood at USD 1.1 billion in 2021, rising to USD 1.3 billion in 2022, while in January 2023, the leading mobile fitness and workout apps recorded almost 21 million downloads worldwide.

Predictions are that the global fitness app market will continue expanding at a compound annual growth rate (CAGR) of 17.6%, reaching USD 4.8 billion by 2030.

In 2024, apps in the eServices fitness market are forecasted to generate revenues of almost USD 1.8 million in the United States alone.

Indeed, the US remained the key market for health and fitness apps in terms of consumer spending during 2022, controlling more than half (51.7%) of all spending across the App Store and Google Play, according to data.ai’s State of Mobile 2023 report.

Eight of the top 10 apps by consumer spending in 2022 are based in the US, including each of the top three (MyFitnessPal, Fitbit, and Calm).

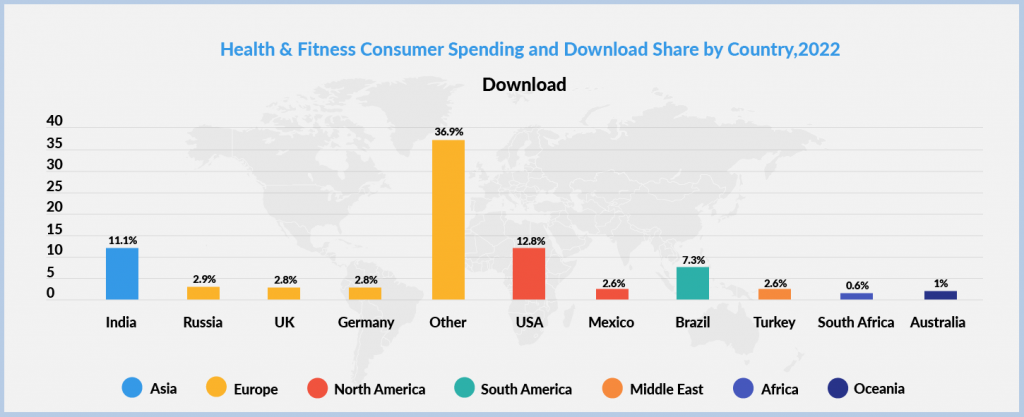

Looking at which countries in the world downloaded the most health and fitness apps in 2022, India accounted for 11.1% of a total download share for Asia of 22.9% .

The continent with the highest share of downloads in 2022 was Europe at 45.4%, while North America came in at 15.4%.

In Europe, the fitness app market is expected to grow significantly between now and 2030, reaching USD 8,755 million at a CAGR of 22.4%.

The market growth in Europe is as a result of rising consumer demand for fitness apps, driven by increased knowledge about healthy lifestyles, and the expanding number of fitness centers and clubs.

Source: data.ai Intelligence

Greater Device Adoption Fuelling App Growth

Asia-Pacific is expected to be the fastest-growing region for fitness apps, with the market expanding at a CAGR of 23% to reach USD 10,955 million by 2030.

This is being attributed largely to the increased affordability of smartphones, meaning more people are using them to access various fitness programs on the go.

Indeed, according to the Mobile Economy Survey 2018, smartphone penetration globally is projected to increase from 57.0% in 2017 to 77.0% by 2025.

The growing adoption of wearable devices, such as Fitbit and Apple Watch, is also aiding market growth.

Wearable devices are expected to register the fastest growth rate (18.6%) of any mobile device between now and 2030.

According to Pew Research Center, as of June 2019, around 21% of individuals in the US were using a wearable device, although the adoption of wearable devices varies according to socioeconomic factors such as income, education, and occupation: the same study showed that 31% of individuals from the household income group of USD 75,000 or above per year use wearable fitness devices, dropping significantly to 12% of users from the household income group of USD 30,000 or less per year.

Segments and Platforms

The global fitness app market is divided into three segments: exercise and weight loss, diet and nutrition, and activity tracking.

Exercise and weight loss dominated the fitness app market with a share of over 54.6% in 2022, thanks to an increasing number of people seeking a health-conscious lifestyle and the desire for continuous health assessment.

Activity tracking – dominated by leading brands Jawbone, Fitbit and Nike – is now the fastest-growing segment in the market, predicted to reach a value of USD 9440 million by 2030 at a CAGR of 23%.

When it comes to platforms, android is expected to be the fastest-growing platform for fitness apps worldwide between now and 2030.

Due to the increased adoption of smartphones globally and a rapidly rising number of Android users specifically, the Android market for fitness apps is predicted to reach a value of USD 19,005 million at a CAGR of 22.7% by 2030.

Leading fitness apps available on the Android platform include MyFitnessPal, Google Fit, Sworkit, Runtastic, and Leap Fitness.

Talking App Discovery

Clearly, the fitness apps space is becoming increasingly crowded, so if you want to get your app in the hands of many more activity-seeking mobile users, you’d do well to team up with an app discovery platform like Appnext.

Today’s fastest-growing mobile discovery technology company in emerging markets, Appnext has partnered with leading mobile carriers and Android manufacturers such as Oppo, Vivo, Samsung and Xiaomi (which have a combined worldwide market share of 48%).

These partnerships enable Appnext to recommend fitness apps to users on their devices from the moment they set up and personalize a new device and throughout their daily mobile journey.

What’s more, Appnext’s proprietary behavioral analytics technology displays contextual and personal app recommendations according to the user’s behavior and intentions.

So recommendations for fitness apps are presented to users who are actively looking for health and exercise programs and advice directly on their mobiles across various placements.

With such personalized recommendations aimed at people specifically looking for health and fitness, the chances of converting potential users into active, loyal users are vastly increased.

In other words, by making Appnext your health and fitness app buddy, you can keep your user acquisition goals well on track this summer season and beyond.

Comments are closed.