For many retailers, mobile traffic equals or exceeds desktop traffic. This is not new. What is new is that mobile sales represent the majority of total e-commerce for brands with successful shopping apps, according to Criteo’s latest commerce report (Q4 2017)

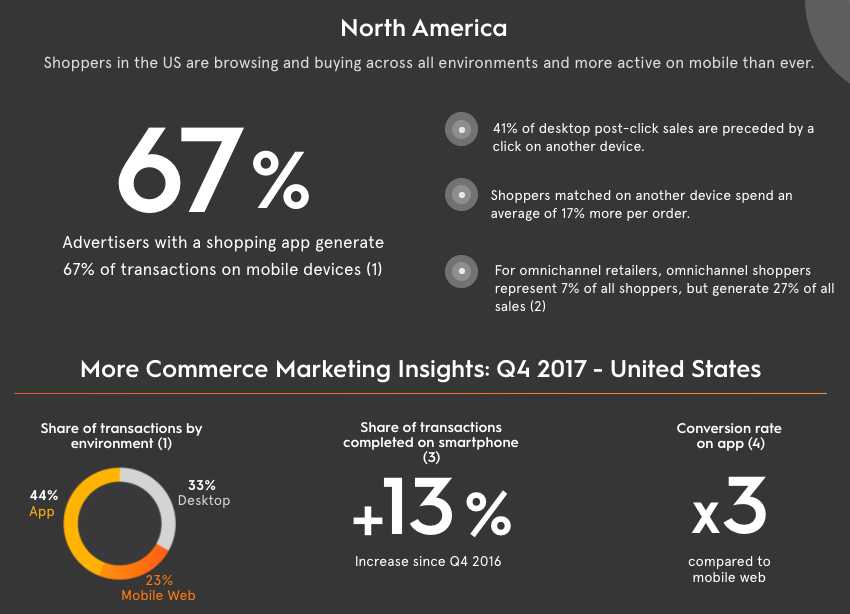

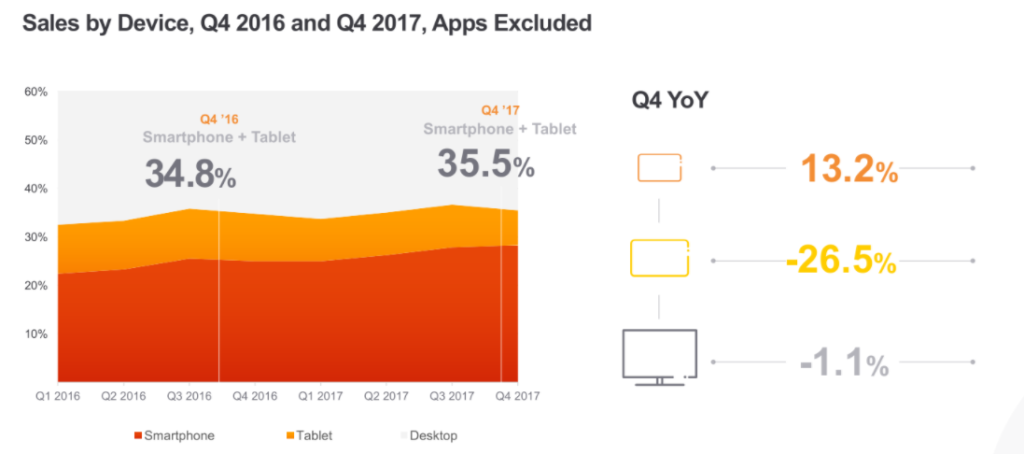

Smartphone Commerce Transactions in North America increased 13% YoY.

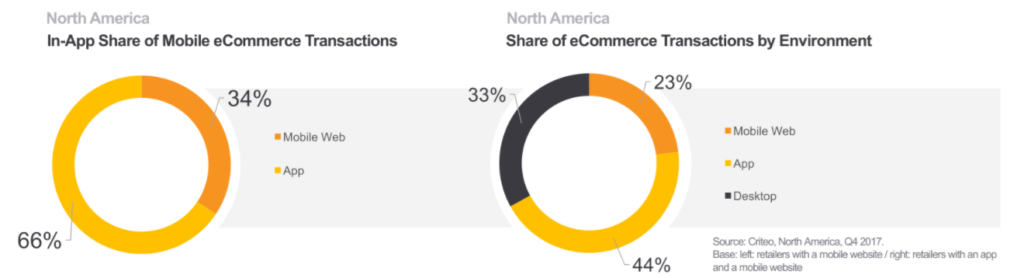

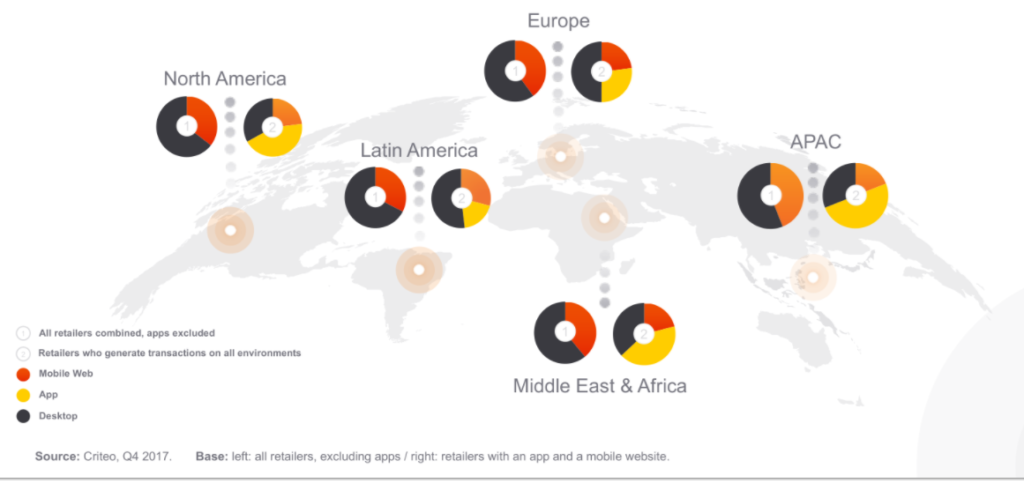

Shoppers in North America remain active on mobile. Advertisers with a shopping app generate 67% of transactions on mobile services, for retailers who generate sales on both mobile web and in-app. Overall, when compared to Q4 2016, YoY sales increased by 13%.

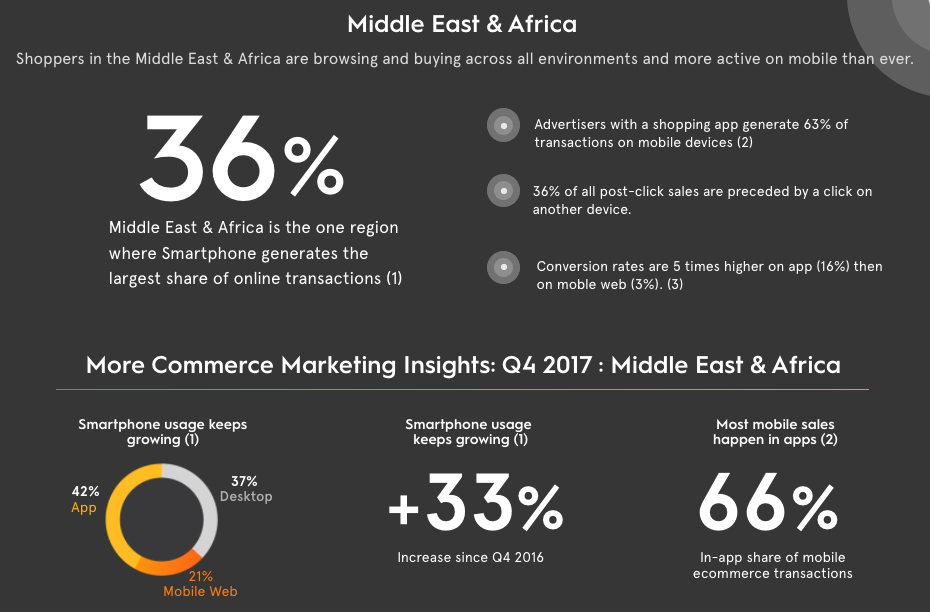

In the Middle East and Africa, Smartphone generates the largest share of online transactions for retailers, excluding apps.

The Middle East and Africa may show us the future, where mobile commerce actually dominates retail sales. Only 37% of transactions occurred on desktop. But apps still make for the best conversions as advertisers with a shopping app generate 66% of transactions on mobile devices.

Latin America remains the fastest growing region for share of mobile transactions, with a year-over-year increase of 37%.

Though tablet usage has decreased to account for just under 2% of all transactions, those in Latin America are savvy app-users, contributing to app conversion rates that are 3 times higher on app than on mobile web. That’s in line with the trends we’ve seen in Latin America in general – there’s been a 37% increase YoY when it comes to mobile transactions.

In Europe, transactions on mobile and desktop are split 50-50, with share of transactions completed on smartphones increasing 21% YoY.

Retailers with a shopping app now generate 44% of their sales on mobile devices. Interestingly, tablet usage is down like in the rest of the world, but still accounts for more than 10% of transactions. Overall, we still saw strong transactional data on smartphones, which increased 21% when compared to Q4 2016.

As mobile commerce—especially in-app transactions—continues to grow, retailers should invest in mobile web and app strategies.

1. Mobile is the majority for retailers with a shopping app

2. Mobile Web Usage Reaches Maturity and Still Growing

Mobile web usage has reached a maturity point, but shoppers rarely stay in one place for long, moving in and out of walled gardens, and are still buying on-the-go, with varying levels of frequency, on all connected devices.

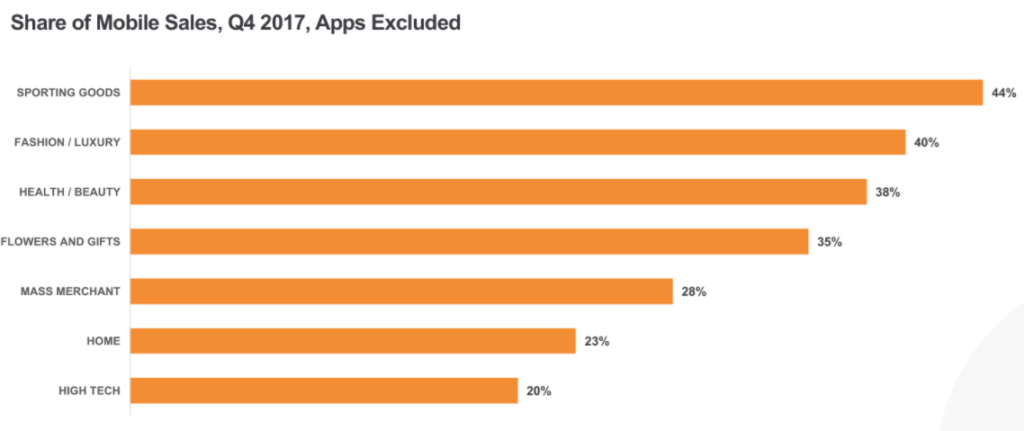

3. Sporting goods and fashion/luxury are the two retail subcategories with the highest share of mobile sales.

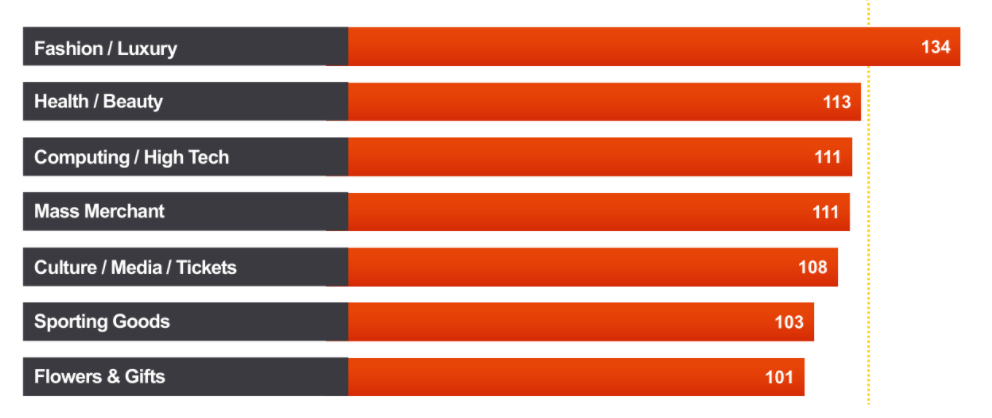

4. Combining Intent Lets You See More Shopping Dollars Per Shopper

Average Order Values Are Significantly Higher for Matched Shoppers.

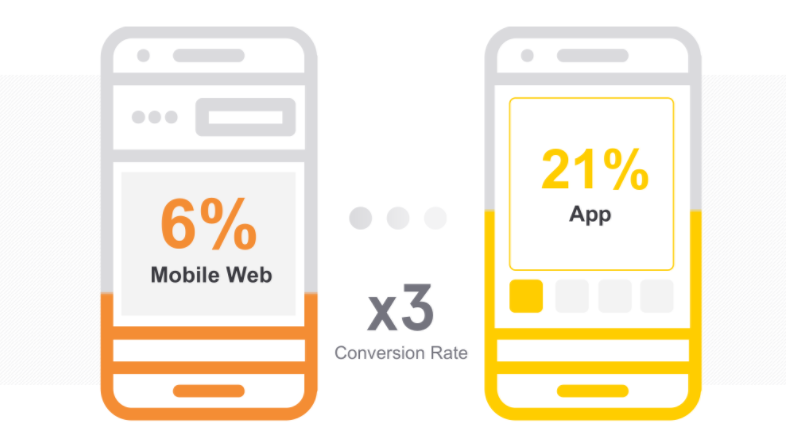

5. Shopping Apps Generate Higher Conversion Rates

In North America, the conversion rate on shopping apps is more than 3 times higher than on mobile web.

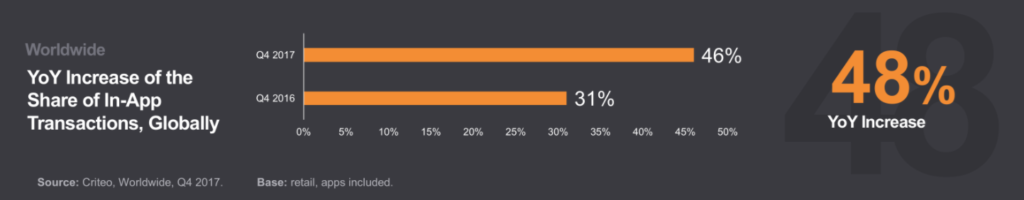

6. In most world regions, mobile now accounts for more than 50% of online transactions, and in-app sales dominate.

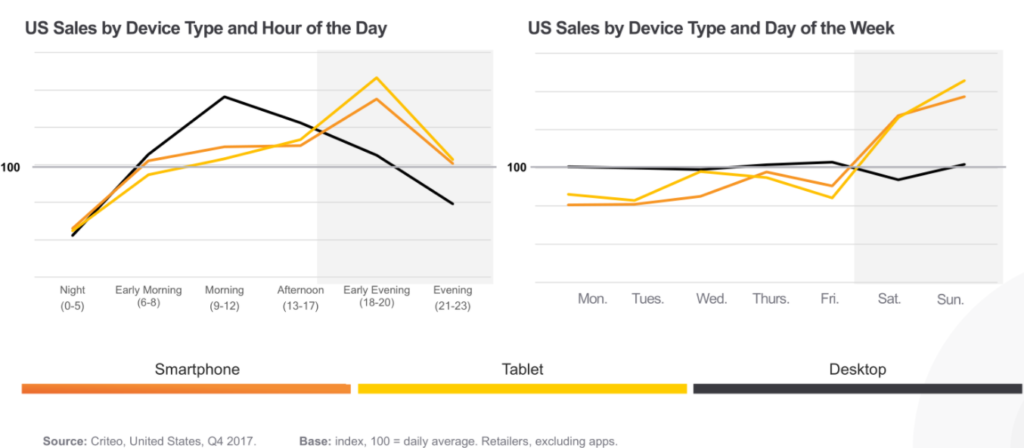

7. Desktop usage dominates working hours, while mobile wins nights and weekends.

Key Findings

App Opportunity

When retailers prioritize app optimization in addition to mobile web, the performance gains are

substantial.

Mobile Growth

Mobile web usage has reached a maturity point, but shoppers rarely stay in one place for long, moving in and out of walled gardens, and are still buying on-the-go, with varying levels of frequency, on all connected devices.

Shopping Moments

Consumers continue to trade desktop for mobile, and back again, depending on the time and day they are shopping online.

Comments are closed.