It’s true to say that the Covid-19 pandemic changed our lifestyles in many ways. While some of those changes have been reversed now that life has returned to normality, others remain – including our desire to order food for delivery via an app. With restaurants closed and fears of exposure to Covid while out shopping at the height of the pandemic in 2020, meal and grocery delivery apps boomed. Indeed, Covid-19 propelled the industry a few years into the future, as millions of people in lockdown ordered food online for the first time. Almost every major food delivery service saw its gross merchandise volume increase by over 75% in 2020; US grocery delivery service Instacart even reported it had achieved its 2022 goals in the third week of lockdown.

The surge in demand has cooled off a bit since 2020, although Deliveroo, DoorDash and Uber Eats all reported higher revenue and gross bookings in 2021 than 2020. But there is still a huge appetite amongst consumers for ordering groceries or their favorite curry, pizza, noodles, sushi – whatever takes their fancy – on their smartphone and having it delivered to their door.

Crunching the Numbers

According to data.ai’s State of Mobile 2023 Report, sessions in food and grocery delivery apps climbed 10% YoY in 2022, compared to 35% YoY growth in 2021 and 17% growth in 2019.

The report reveals that growth in some markets plateaued last year, while others continued to flourish: while sessions dropped slightly in Brazil in 2022, other top markets like India (31% growth YoY), Germany, France, Japan, and Turkey (57% growth YoY) maintained strong growth.

The website SignHouse reports that China is the largest market for food delivery globally, generating $309.90bn in revenue from food delivery services in 2022, followed by the US with $185bn, South Korea with $34.33bn, the UK with $33.14bn, and Japan with $29.52bn.

For many people around the world, ordering from food delivery apps has become a weekly habit, and the market is projected to grow further over the next few years.

According to Statista, revenue in the online food delivery market is projected to reach a whopping US$1.02tn in 2023, with an annual growth rate (CAGR 2023-2027) of 12.67%, reaching a market volume of US$1.65tn by 2027.

Grocery Delivery makes up the market’s largest segment, with a projected market volume of US$0.63tn in 2023, and an expected revenue growth of 22.2% in 2024.

In the Meal Delivery segment, user penetration is expected to be at 25.2% in 2023, with the number of users predicted to reach 2.45bn by 2027.

Putting Your App on the Menu

Of course, the popularity of food delivery apps means it’s a very crowded space, so how do you persuade consumers looking to order food to choose your app?

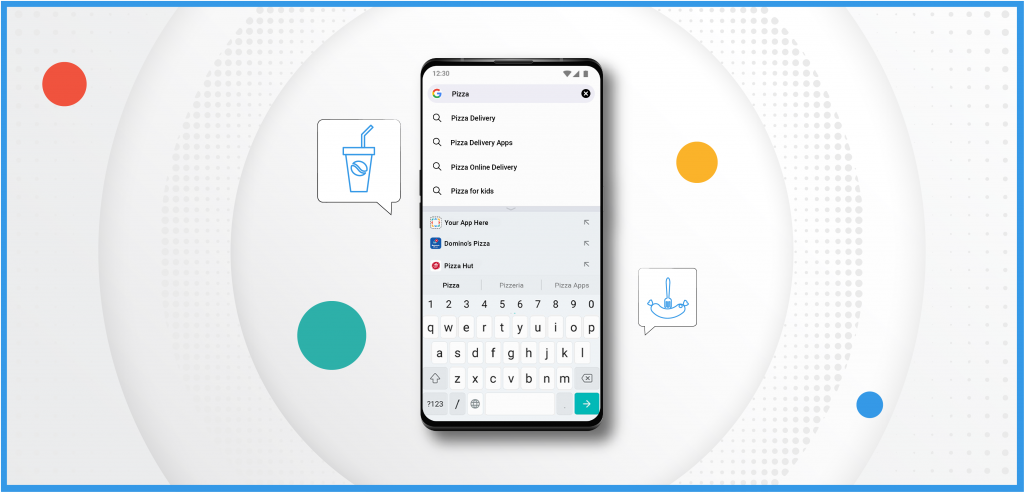

One of the most effective ways to boost app discovery is through on-device app recommendations: in other words, relevant apps can be suggested to users based on their intent, preferences, behaviors, and past interactions. An example of this would be if a user has shown interest in pizza delivery, they can be presented with recommendations for other apps that offer pizza or other food delivery.

Through its proprietary behavioral analytics technology, leading app discovery platform Appnext offers just that kind of solution to its growing client base of food delivery apps. Food and drink apps were one of Appnext’s best-performing verticals in 2022, with installs up by 86% on the previous year.

Amongst Appnext’s food delivery clients are Turkish QSR (quick-service restaurant) operator Tikla Gelsin, Swiggy (SuprDaily ), India-based shopping app Tata Neu, Pizza Hut in India, and Indian meat and fish store TenderCuts: all have witnessed a significant uplift in installs and purchases since utilizing Appnext’s discovery platform.

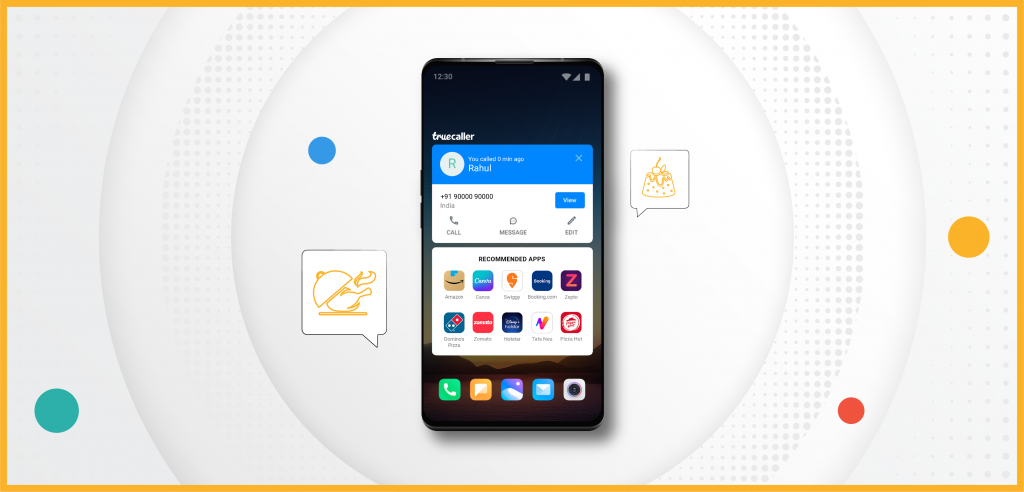

Appnext’s on-device app recommendations can be made to users at various placements on their phones during their daily mobile journey. For example, recommendations can appear on the minus one screen (when swiping right for content, when updating apps in the store, or when ending a call), providing users with personalized and contextual suggestions at the moment they need them.

What’s more, through Appnext’s partnership with leading OEM brands, it offers unmatched strategically placed recommendations directly on the device, such as folders and widgets, enabling continuous engagement with users throughout the day.

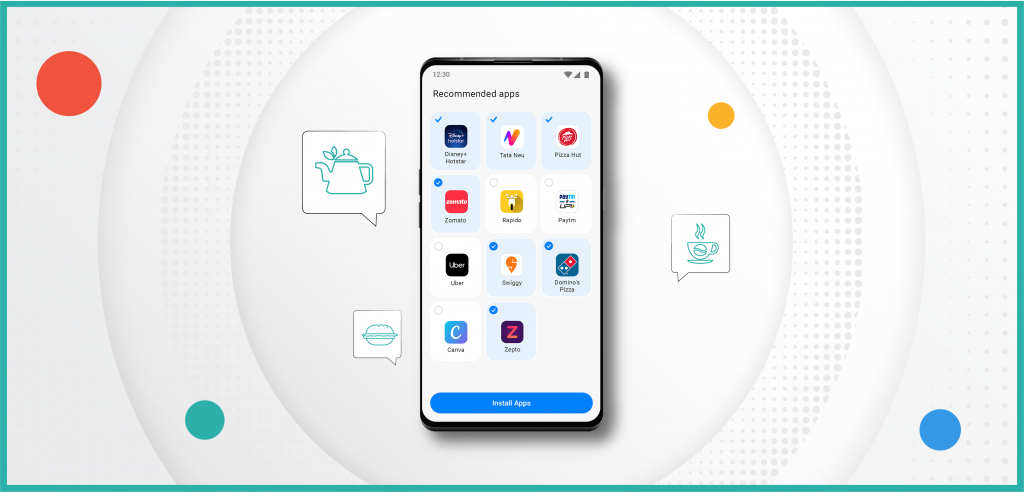

Newly-purchased devices present an unparalleled opportunity to get the full attention of high-intent users as they personalize their devices for the first time, and this is another area where Appnext’s tech comes into play.

Appnext has partnered with leading mobile carriers and Android OEMs such as Oppo, Vivo, Samsung and Xiaomi (which have a combined worldwide market share of 48%), enabling food delivery app recommendations to users on their devices from the moment they set up and personalize a new device and throughout their daily mobile journey.

With such timely and relevant tech-powered recommendations being made to mobile users at every available opportunity according to their intentions, the impact on their chances of discovering your app and using it to order their next meal or grocery shop can’t be underestimated.

Comments are closed.